What is Financial Wellness?

Lots of financial advisors and retirement plan providers are promising to deliver “financial wellness”. But when they talk about wellness, what do they mean?

When pressed, few can offer a coherent definition of wellness, never mind a clear approach to delivering it.

Unfortunately, for many, the concept of wellness is little more than what you might see on a Hallmark card or a giftshop pillow.

So how should wellness be defined, and what type of framework could be used to help advisors deliver it?

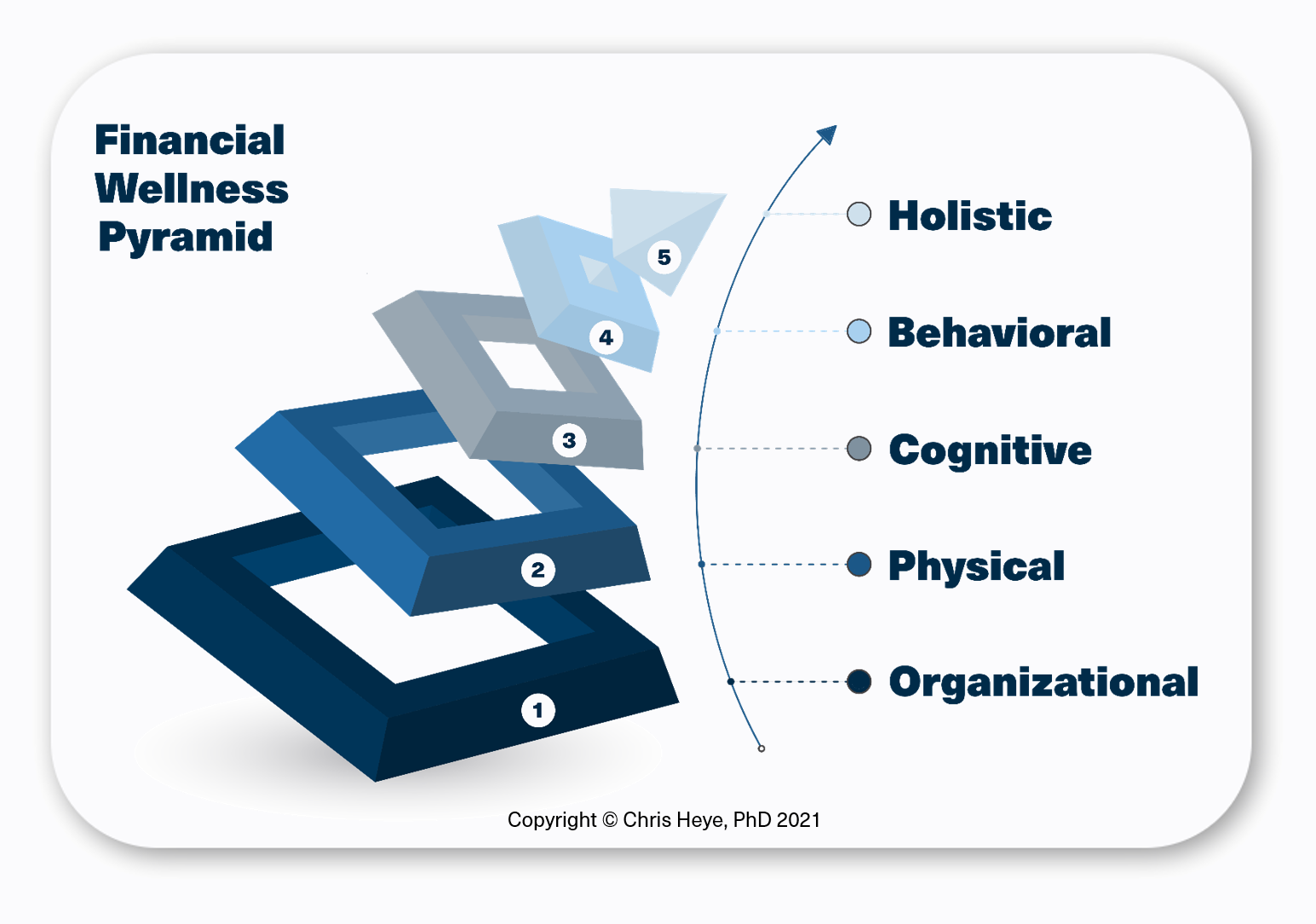

Financial wellness is more than having a budget and a savings plan. It is best viewed as a hierarchy of states and actions. It has physical, behavioral, and cognitive aspects. It means being prepared for, and protected from, the financial risks posed by health and longevity-related challenges.

Financial wellness might best be viewed as a tiered pyramid, with each layer building on the one below, analogous to Maslow’s hierarchy of needs. The proposed wellness hierarchy is shown in the graphic below. What many people refer to as "financial wellness" fits in the category of "organizational" wellness. Having both an investment and a savings plan is important, but hardly sufficient for maintaining holistic wellness.

At the top of the pyramid lies holistic wellness. Holistic financial wellness involves the successful management of all of the stages that lie below it. While achieving holistic wellness may seem like a tall order, there are manageable steps your client can take over time that will move them closer to the ultimate goal. In addition to being well-organized, holistic wellness also requires being prepared, staying connected, and demonstrating self-awareness.

For more on my definition of wellness, watch the video below or visit our thought leadership page to my article in the Journal of Financial Planning.