Help your client help you right now - and reap the benefits.

The drop in stock prices is very unsettling to even the most experienced investors. No one knows what will happen with the coronavirus pandemic - or when. But you sure can’t wait to be sure. Clients don’t need you when everything is going well - they need you when the wheels come off the bus. And we now have a head on crash between the bull market train and the healthcare bus. And though no one could have predicted the violence and speed, these two forces of health and wealth have been on a collision course since the first Baby Boomer was born. Bear markets have a tendency to accelerate trends, and we already had a huge and rapidly aging clientele across the advice industry that is suddenly now in more acute need. And the bull market has had a historic run from March 6, 2009 when the Dow Jones was 6,469. We knew that market had to breathe at some point. Bear markets are created by bull markets, after all.

So what now?

The planning topic most ripe now is the one already the most overlooked and delayed by both advisors and clients - longevity planning. If ever there was a reminder of the need to focus on health, the COVID-19 pandemic is a billboard. Longevity is inevitable, but knowing how to step in can be difficult. The pandemic opened the door to tough topics and Whealthcare Planning has made the process easy by giving you simple tools to share with your clients. Focus on the real life issues that will go on no matter the markets - the four key life transitions of aging that everyone must face and that will change as we age. Preparation now makes all the difference later:

Who Will Help You With Financial Decision-making? - What happens if your client cannot make decisions about their accounts? They could be physically (or cognitively) ill, traveling in a remote location, or aging. All these issues are now top of mind. Who can be trusted to act in their best interest? FINRA has mandated “Trusted Contact” rules - you can do better.

Where Will You Live? - Most older people would prefer to stay in their home, especially in the age of COVID-19. But can they? What is the plan to provide for the costs, the maintenance, the safety, the convenience, the proximity to friends and family?

How Will You Pay for Health Care? - A very complex topic that is now on the front page every day. Health care has been an assumed service for years in the US but we are seeing its limits. And the cost elements can be confusing - Medicare, private insurance and out-of-pocket costs. Almost everyone can have a better plan.

How Will You Get Around? - Transportation is independence for many older people but it creates significant risks when their eyesight or hearing are not so good - or worse. Safety of your client and others in the community becomes the priority but the conversation is a tricky one. The families will thank you.

Crises make people feel like they’ve lost control. Bear markets scream at clients and the clients hear, “I might not be able to do...” This is the best opportunity you will ever have to get clients focused on planning. Even if it is only a single problem you solve, it is a step in the right direction. We know most clients have all kinds of plans, but most are incomplete. I’m not saying everyone needs a full blown in-depth plan but nearly everyone could do better. With care, I would contrast our collective view of medical health. Just like bear markets can reveal the instability of your financial plan, a pandemic shines a harsh light on “healthy” and redefines both your actual condition and your ability to protect yourself. Crash courses about life taking place simultaneously right now. Give clients the gift of some control over their future. A lot more productive than hoarding toilet paper.

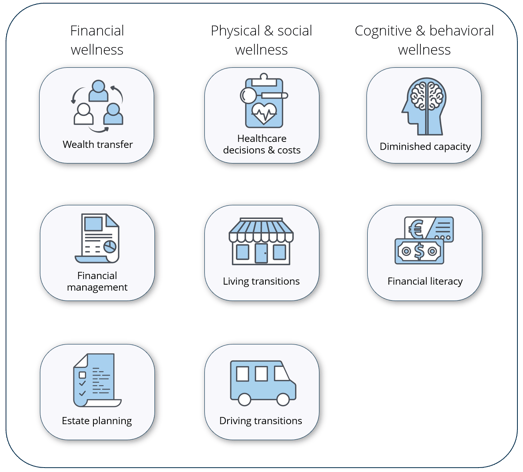

The Whealthcare Planning team has identified eight key issues of longevity planning that offer advisors and their clients an excellent basis for conversations now. Help clients take control of their future and avoid the pitfalls.

The Whealthcare Planning CARE Package is a few clicks away:

- Simple tools make it easy to engage clients. Confidential questionnaires you send to clients via an online link. They complete the short 10 minute interactions and you can then talk about the results.

- Education is built into the process, helping clients better understand the issues and how they can protect themselves and plan better.

- Immediate action steps provided with each interaction give you substantive takeaways you can work on together right away.

Don’t wait for clarity - lean in. The history of bear markets confirms this is the very best time to solidify your best client relationships, consolidate assets of your more tentative clients, and outright earn brand new clients from advisors too timid to connect. And just like bear markets, these opportunities are not common, so the rewards go to the advisors willing to step up - and step in. Now.

Please see www.whealthcareplan.com for more information. And let us know how we can help!